What is TransferStamp

TransferStamp.com is an online system created for municipalities to streamline the antiquated real estate transfer tax process, saving local governments time and money with an efficient cloud-based platform.

The Problem

Municipalities are unique; very few operate the same. For years, the parties servicing real estate transactions—municipal employees, attorneys, and title companies—have all had to make an in-person visit (or multiple visits) to submit and pay for orders, fill out paper forms, and undertake repetitive physical processes.

TransferStamp.com eliminates:

- In-person transactions

- Prolonged processing time

- Unnecessary printing

- Scanning

- Document storage costs

- Human error

The TransferStamp solution:

- Online, user-friendly forms

- Fast processing time

- Cloud-based storage

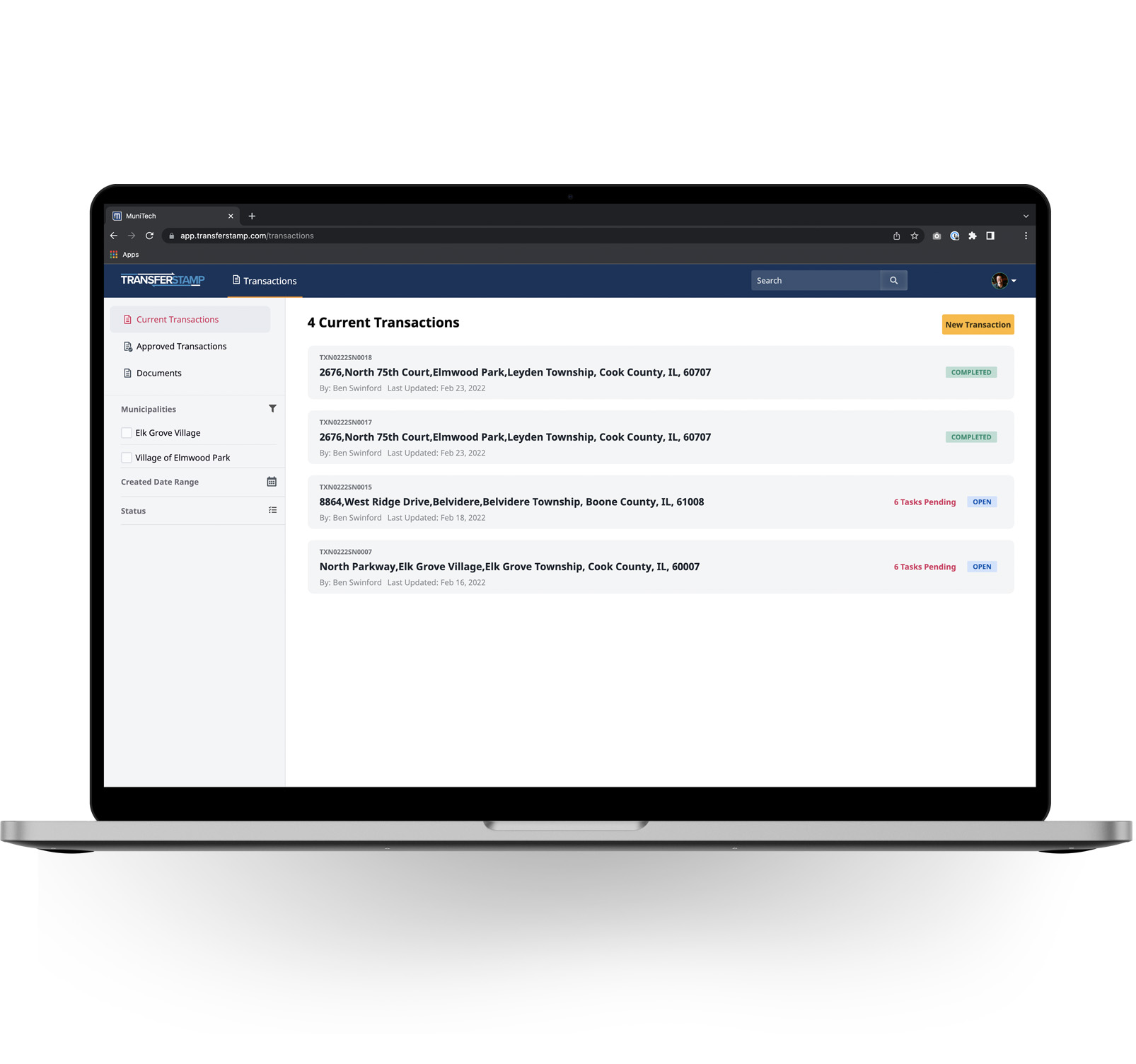

- Database for reference to previous transactions

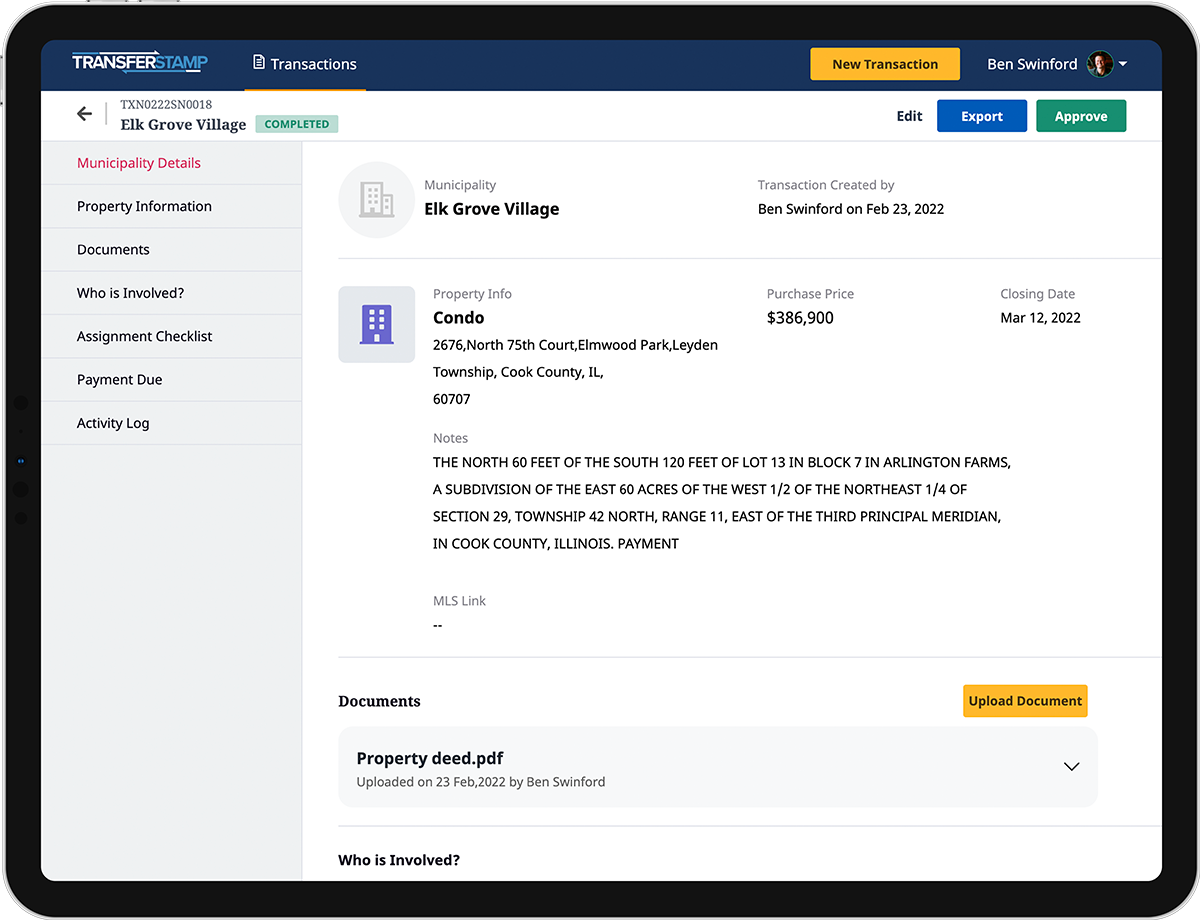

TransferStamp provides an all-inclusive cloud-based software platform that:

- Features user-friendly transaction generation

- Links the relevant transaction parties (municipality, attorneys, realtors, title company, buyer/seller)

- Provides real-time task tracking and notifications

- Auto-generates recurring party information

- Automatically calculates applicable taxes

- Collects applicable transaction documents (e.g., deed, PTAX, local forms, etc.)

- Generates reports

- Offers multiyear data tracking

- Allows online payments

- Provides white-labeled features and branding for each municipality

- Offers mobile-friendly use and viewing

- provides a customizable app for additional municipal services (e.g., managing physical inspections)

Besides saving time and money, there are many added benefits to using TransferStamp. Municipalities can track trends of sales by neighborhood codes, zip codes, and the census track. Having transactional information at your fingertips also helps mitigate someone filing a false deed.

Pricing

Municipal clients who exclusively use TransferStamp to manage their real estate transfer stamp processes only pay a $1/month licensing fee.

The transaction party required to pay for the stamp pays a nominal convenience fee, typically absorbed by the seller’s attorney or REO listing agent who originates the transaction.